Growing revenue is tough enough, but now leads are using new decision making processes to weed out high-risk providers who prioritise payment over performance.

Honest, capable providers risk being misunderstood because they don’t know how to work with these systems, often coming across as risky themselves. To non-experts, separating true quality from red flags is harder than ever, which is why you need to approach selling to them in the right way in the era of AI.

We created this blog post to help you understand:

- What a DMU is, their purpose and motivations

- How they torpedo sales success for B2B solution providers

- How to get a DMU on your side and turn them into advocates

So, if you’ve noticed sales performance has been declining in your business over the past couple of years and you haven’t yet figured out why, or you’re still trying (and failing) to consistently generate and convert high value leads in the B2B tech space…

This article is for you.

The Problem, The Causes & The Solution In A Nutshell

Your leads are sick and tired of being treated like idiots and having both their time and money wasted over and over again.

Not by you, but by your competitors, the ones who consistently over promise and underdeliver, never giving their clients the results they deserve.

They lost hope that your sector would self regulate and get better – a long time ago – so they took matters into their own hands.

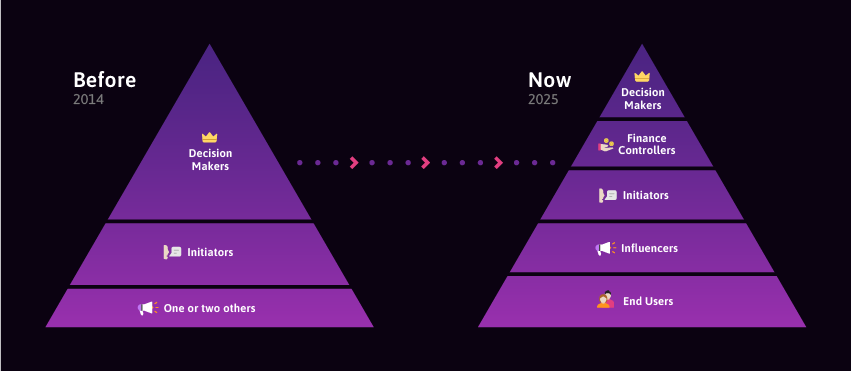

To break the cycle of continuously trying out new providers only to be let down time and time again, your leads have been growing their Decision Making Units (DMU). A group of people tasked with developing a deeper understanding of the available solutions and their providers before investing.

No matter which data you look at, the DMU of companies seeking new tech solutions is growing year on year and it has been since 2014.

It makes sense when you know that technology, and the solutions that exist around it, also keep getting more and more complex, and thus more and more difficult for non-experts to actually understand.

DMUs growing in size every year means:

- The decision making power of individual CEOs and Directors is decreasing

- Their appetite for unbiased, easy to digest information is increasing

- Time and energy devoted to researching the right solutions is increasing

- Caution around unknown providers is increasing

- The number of people needed to reach a consensus is increasing

So if, like all the other B2B solution providers struggling to hit £/$5-10m revenue, your main/only sales function is reaching out to high level decision makers to immediately try and book a sales meeting and sign them over 2-3 meetings…

And you still don’t see branding, marketing or online presence as important…

You’re doing what’s known in 2025 as old-school or very basic sales, devoid of strategy.

If this is true for you – and for most it will be – the bad news is that without more sophisticated and holistic revenue growth efforts, you will continue to suffer with:

- Very few, if any, positive replies to cold outreach efforts

- Low and declining numbers of good sales meetings with good leads

- High rates of sudden ghosting from leads after the first sales meetings

- Lower than average and declining conversion rates with poor/negative ROI

- More confusion, stress and anxiety about financial security

The good news is that there is a solution and it doesn’t take much to wrap your head around it.

I’ll now touch briefly on the main reasons behind why the above is an accurate 2-3 year forecast for B2B solution providers still subscribing to old-school strategies.

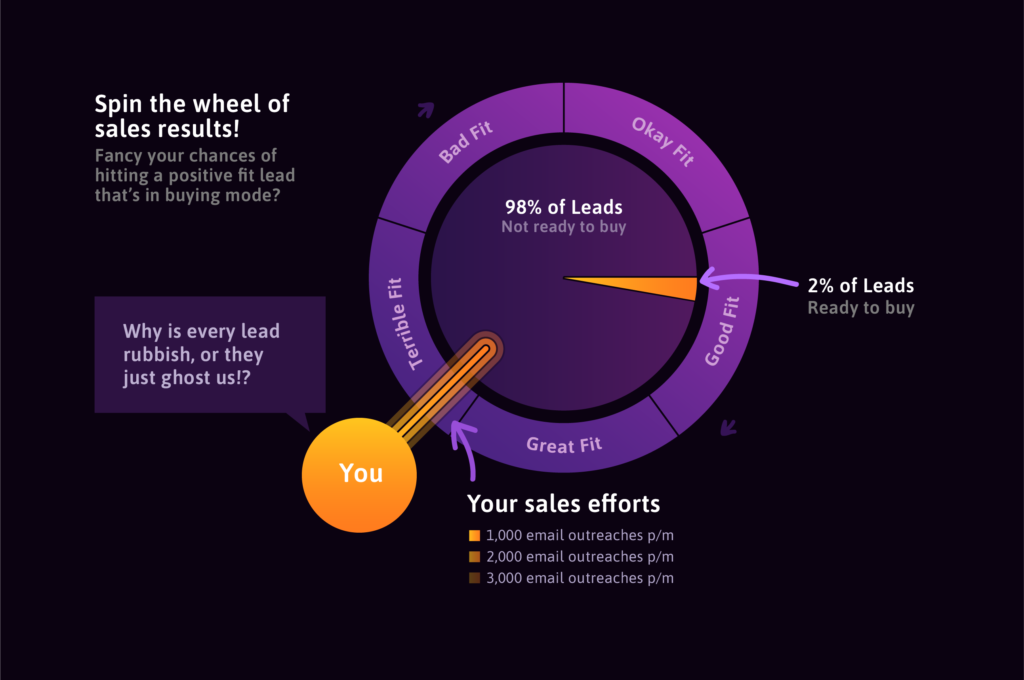

One: Focusing Only on Ready-to-Buy-Leads Alienates 95% – 98% of Your Market

It doesn’t matter what data you look at, all of them will tell you that in the B2B space, in any industry or sector, only a tiny fraction of the market is ready to invest into new services at any given time.

Just 2-5%.

It’s so important to understand how to grade leads properly, by separating lead readiness from lead qualification.

A lead can still be an amazing, even perfect match for your business, they may just not be ready. This doesn’t mean you should discard them as a bad lead, just because:

- They’re stuck in a 3 year contract with another provider they don’t like

- The CEO is going through a messy divorce and isn’t ready for a big project

- Two of the three directors are going to be in hospital for another 4 months

- They’re waiting for one more big client to create new budget before they can invest

- Two key members of the team left during a big project and the focus is on replacing them

You get the gist – people in those positions wouldn’t consider themselves “waste of time” leads, they’re just not ready yet.

These events (and many others) can span months, even years. It doesn’t make sense to alienate up to 98% of your audience just because they don’t want to rush the most important things in their lives to satisfy your desire to make more money.

Expecting them to move to your timescales is like expecting someone you’ve been dating for two weeks to accept a marriage proposal; in most cases this isn’t going to be what they want and no amount of persuasion is going to result in them saying yes.

Two: 78% of B2B Buyers Have Already Chosen a Solution & Preferred Provider by The Time They’re in Buying Mode

(source: 6 Sense)

Let’s do a few calculations to understand the big picture.

If your market of ideal customers is 1,000,000 (one million) and we’re extremely optimistic and say that 5% are in buying mode (rather than 2%) then you’re left with just 50,000 businesses.

Of that 50k, a whopping 78%, or 39,000, have already identified the solution they want and have strong feelings for another provider.

So on the rare occasion that you do reach out to a lead that’s in buying mode, chances are they’ve already been “dating” and have strong feelings for another company.

These are the extremely frustrating leads who take sales meetings with other providers like you, show a lot of interest and then ghost for seemingly no reason.

See, what happens is that 6-12 months before you make first contact, another company did the same thing but their approach was to shower them with content and advice that made it really easy for them to figure out which solution is right for them and which type of provider they need.

They weren’t chomping at the bit, trying to book sales meetings and get them signed up ASAP.

They didn’t look desperate.

It’s no coincidence that companies educating leads during the 6-12 month research stage, just happen to offer the solution their leads ultimately choose and go on to become the provider that wins the client 84% of the time. (Source: 6 Sense)

Focusing only on the smallest, most difficult to convert segment of a market isn’t the smartest strategy.

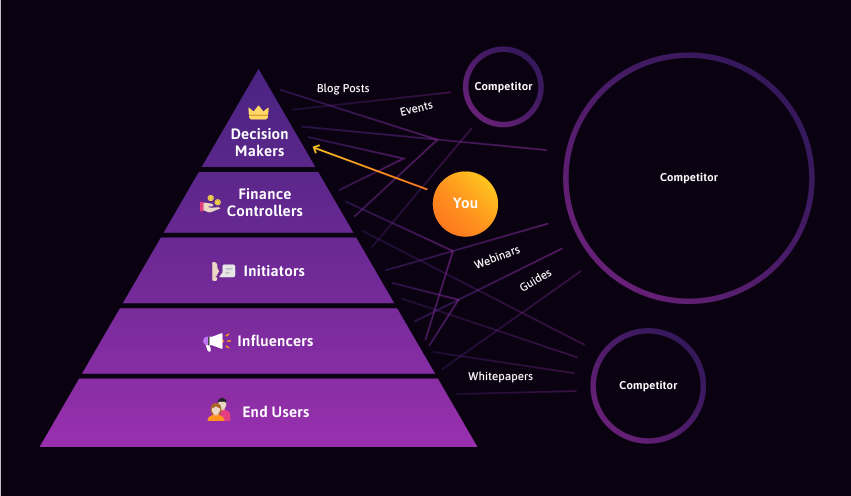

Three: Sales Activities Should Revolve Primarily Around The DMU

High level decision makers should not be your primary focus, they are losing their power to the DMU. Even if you do, for example, win over the CEO you’re still unlikely to win the contract without also winning over their DMU.

Lone high level decision makers are highly unlikely to go against the collective decision of the team they probably helped put in place to research, discuss and reach a consensus on the single best solution and provider.

But there’s a problem…

Members of the DMU do not typically join sales meetings, they operate behind the scenes often having to squeeze these new responsibilities in alongside those of their primary (full-time) function within the business.

The only way to influence this group as a whole is to get content into the hands of each DMU member. This content has to be created with a strong understanding of the different informational requirements each role has and all the various content consumption styles within the group.

If you can’t do this, you cannot influence the DMU.

At best, assuming your sales meetings with high level decision makers go flawlessly, you may convince one or two, maybe three of the 6, 8, 10, 12+ people tasked with deciding on whether or not you are the best company to spend their money with.

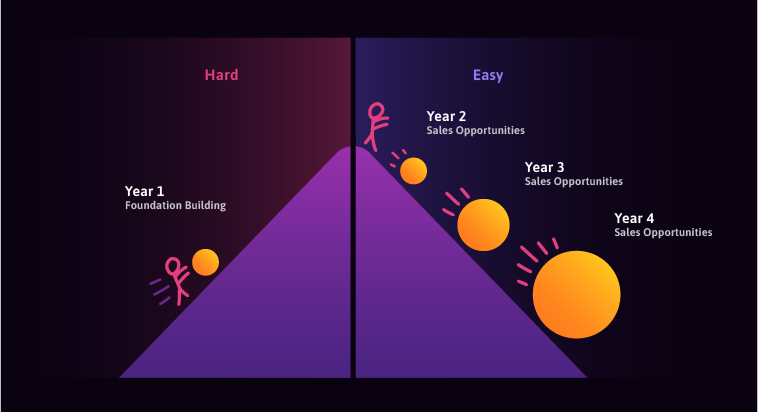

Smart B2B Solution Providers Focus on Building The Snowball Effect

These smart companies are the ones worrying about which leads to turn away, not whether they’ll get enough to avoid having to fire people.

Two examples of the snowball effect:

SEO – Landing pages and content created in year one combine to create significant site-wide subject authority that makes it possible (without any extra effort) to rank top for much higher value keywords in years two and three.

Cold Outreach – The 12,000 – 36,000 leads you reached out to and nurtured in year one, remember your brand and reach out to set up sales meetings with you in years two and three.

Every year you invest the same amount of energy, but the rewards begin to snowball.

This works at both ends, with new leads asking you for sales meetings and existing clients making more referrals as your marketing and sales processes improve.

In Conclusion

“Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win” – Sun Tzu – The Art of War

Smart, successful B2B providers know that nurtured leads will eventually switch into buying mode, and when they do there’s an 84% chance they’ll beat all other competitors and win the contract.

These clever sausages are going into sales meetings, knowing that without even needing to try, they’re probably going to win the work because the lead has practically already chosen to work with them.

They’re not just growing, they’re scaling. The effort remains the same, but revenue keeps going up and up.

This is in stark contrast to the vast majority of less successful B2B solution providers who spend years going round in circles, chasing quick wins, focusing on the absolute tiniest and most difficult to convert segment of the market with 10-20 year old “pre-AI” strategies, getting frustrated or pissed off when their revenue stagnates or starts to decline.

Next Steps

If you’ve read up to this point there’s a good chance you’re on-board with a lot of what you’ve just read. If you’re wondering what to do next, you’ve got some options:

- If you want to find out more, would prefer to speak to an expert but you’re not ready to invest and don’t want to be sold to you can book in for a free Expert Q&A session here.

- If you’re feeling stuck and lost with B2B marketing and sales for complex solutions or long/intricate sales cycles, check out our free self-serve diagnostic tool here.

- If you are ready to invest and are on the lookout for a new marketing/sales partner that focuses on revenue growth instead of vanity metrics, you can book in for a free consultation here.